Finceptor Bonds: How Does it Work?

Your access to discounted tokens: The Name is Bond....

Navigating the labyrinth of DeFi can be complex, but clarity is key. Let's ditch the fancy jargon and unpack Finceptor's bonding process in straightforward terms.

TL;DR

A bond is a simple way to buy tokens at a discounted price. In exchange for acquiring those tokens at a discount, a short-term lock-up period is applied.

Let’s Paint a Word Picture

We always find it easier to understand concepts through examples, so let’s imagine a token traded on public exchanges, looking to enhance its liquidity—essential for a healthy trading environment. It's also strategizing to diversify its holdings, trading some of its protocol tokens for strategic assets and stablecoins. This diversification is crucial for building a resilient treasury, following the golden rule of investment: never keep all your eggs in one basket.

The goal? Acquire stablecoins or quick liquidity to deploy to its pools or to diversify its reserves. The source? Non-circulating treasury tokens, ready for sale, providing immediate funds. However, this sale can trigger a price drop—a less-than-ideal outcome.

The Name is Bond

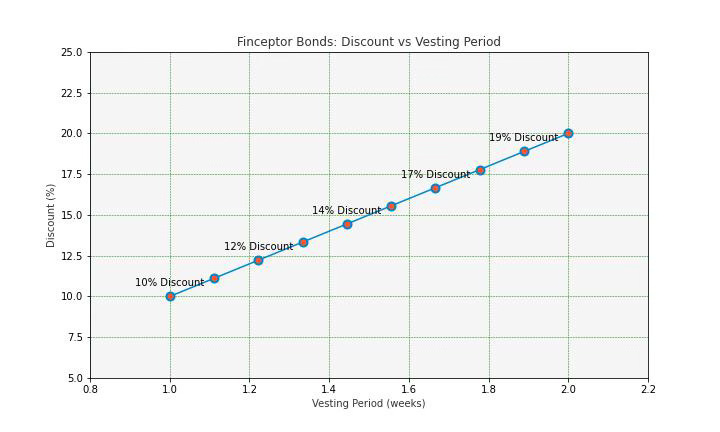

Enter the solution: bonding. Here's how it works: the project sends treasury tokens to Finceptor, which we then offer them at a discount with a smart vesting period. Picture a token worth $10 on the market; we offer it for $8, meaning a 20% discount, with a vesting period of—say, two weeks. But the plot thickens. As demand increases, the discount rate and vesting terms adjust dynamically. Another investor who comes across this deal later may find a 10% discount with a one-week vesting period. This strategy generates immediate capital while dispersing selling pressure—a strategic win-win.

Our dynamic Bonds adapt as more investors jump in, balancing the benefits for all. Early investors lock in better discounts, while later participants enjoy less vesting terms. It's a win-win, a dynamic dance that keeps the market lively and participants engaged.

The mentioned scenario can be visualized with the graphic below.

As you can see from the figure, as the sale progresses, the discount rate and vesting periods are decreasing.

But there's more to Bonds than just discounts. They spread out sell pressure, diversify the treasury with immediate funds, and boost overall liquidity. It's a savvy move for both the project and the investor, creating a more stable financial journey.

A Real Life Example

For example, Finceptor’s last project, Virtual Versions (VV), is trading at $0.008 per token as of this writing. Let’s suppose that the VV team needs immediate cash flow to pay salaries, list on CEXes, or grow their liquidity. They need to sell their treasury VV tokens on the market to generate cash (stablecoins). But that would hurt the market price, trigger selling pressure, and decreasing the project valuation.

Instead, they can use the Finceptor Bonds, selling off some of their treasury tokens at a discounted price with a short-term lock-up period. That way, the market price will be what it is and the sell pressure will be distributed to community, which is good for their investors. VV can access immediate cash flow to finance its operations. Moreover, bond buyers can access the discounted tokens — say, buying $0.007 per VV token while it’s trading at $0.008 in exchange for 10-day linear vesting. Users adapt this bond as a part of their investment/trading strategies.

In fancier terms: You unlock the potential of over-the-counter (OTC) deals with Finceptor's Bond mechanism. It's a financial innovation that allows you to purchase publicly traded tokens at a discount directly from a project's treasury with a smart vesting period—bringing institutional deal-making to your portfolio.

Long story short: Tokens are auctioned off at a discounted price with vesting relative to the market in exchange for immediate cash flow.

Ready to bond with the future of investing?

About Finceptor

Finceptor is a multi-chain liquidity and community growth platform for unlaunched and publicly traded tokens through liquidity vaults and DeFi bonds.

Liquidity Vault is an on-chain initial liquidity bootstrapping pool to build protocol-owned liquidity

Bond is a structured protocol-owned liquidity bootstrapping and token liquidation tool for publicly traded tokens

Launchpad for strategic token launch and sales

LFG🚀🚀🚀

awesome project always succes