Cliff & Vesting in Crypto Explained | OpenPad Web3 Investment

Exploring Cliff & Vesting in the crypto space, how OpenPad utilizes it and why projects should have this critical mechanism.

TL;DR:

Cliffs represent the period of time that must pass before the release of the tokens starts.

Vesting, represents a process in which assets (usually tokens) are locked and released over a period of time.

Traditionally companies use these mechanisms to incentivize employees but in the crypto space they serve a multitude of purposes.

What are Cliffs?

Cliffs refer to the amount of time that must pass before the tokens are released. The length of the cliffs varies depending on the allocation's purpose. The cliff for tokens awarded to a project's staff and advisers, for example, may be 16 months, while the one for promotions and collaborations could be 3 months. The vesting period begins when the cliff period ends.

Purpose of Vesting

In traditional finance, some companies also offer equity to their employees. However, if they all release the stock at the same time, it's usual to see selling pressure on exchanges, driving stock prices down. As a result, companies frequently implement a vesting term to postpone the transfer of promised assets.

In the blockchain space, visionary teams and founders mint tokens and sell them to VCs, private capitals, and the public through Initial DEX Offerings (IDO) to support the disrupting ideas they are building. As these sales conduct in a decentralized manner, anyone who sees the potential can participate in token sales.

After the conclusion of the token sale, participants will receive tokens based on a predetermined exchange rate. If they are given all of the tokens they purchased, it is very likely to experience a huge sell-off once the token is listed on centralized or even decentralized exchanges. This is widely popular as rug pulls. That’s where vesting comes to the rescue.

Vesting: Delaying access to assets.

Types of Vesting

• Linear Vesting: The distribution of tokens in equal parts within a certain period of time is known as linear vesting. The time period can be days, weeks, months or even years.

• Twisted Vesting: The distribution of tokens in random parts within a variety of time periods is known as twisted vesting. The time period varies from days, weeks, months or even years.

Applied Example of Cliff and Vesting in OpenPad

$OPN Token

$OPN is a multi-functional deflationary token as it serves the utility (e.g., guaranteed allocation), membership (e.g., IDOs) and governance (e.g., DAO voting) in the OpenPad ecosystem.

Symbol: $OPN

Decimals: 18

Total Supply (Hard Cap): 100,000,000 (100M)

Blockchain: Binance Smart Chain (BSC)

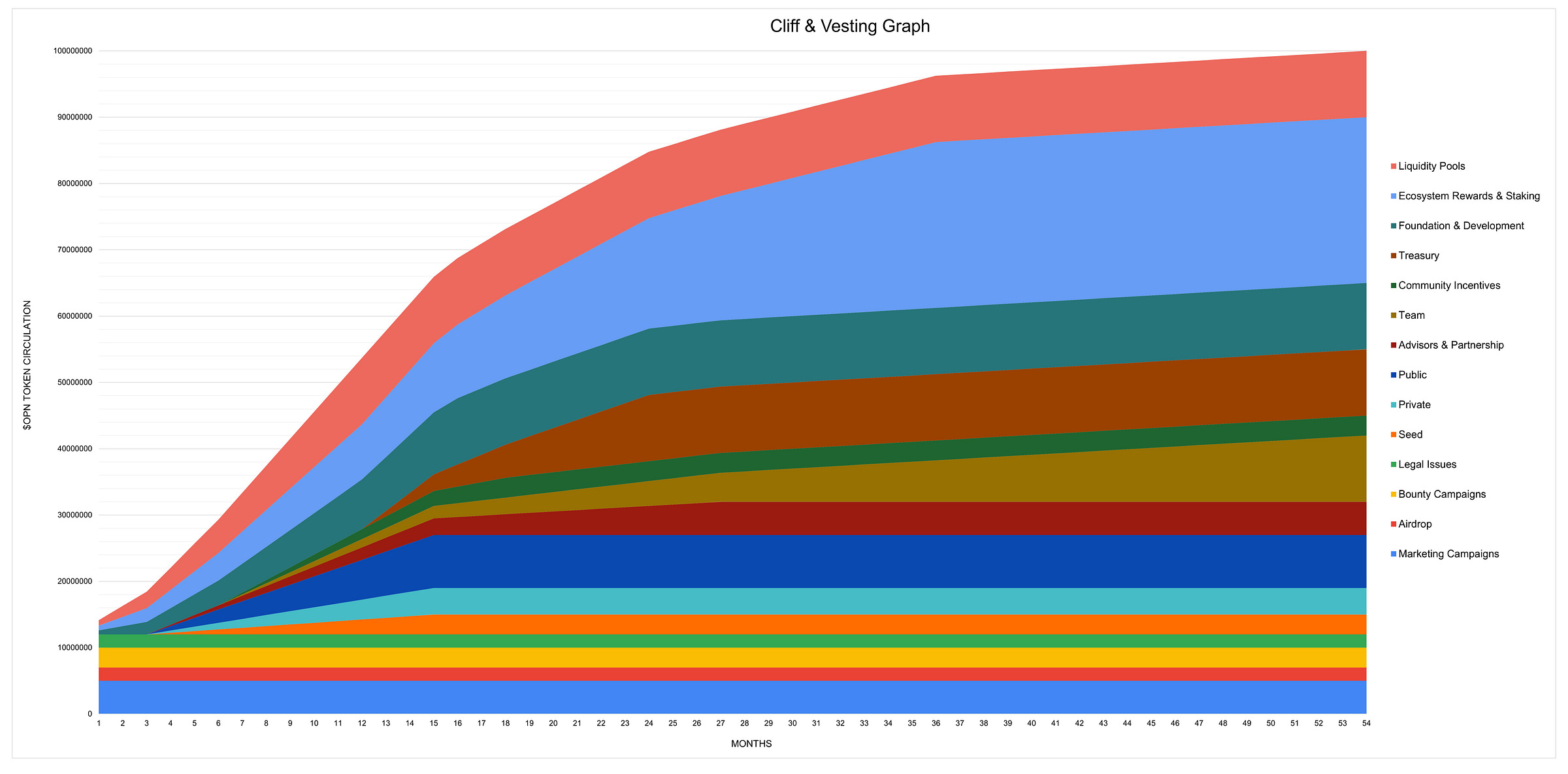

Distribution and Release: Quick Summary of Tokenomics.

$OPN Allocation

For interactive visualization, please click here.

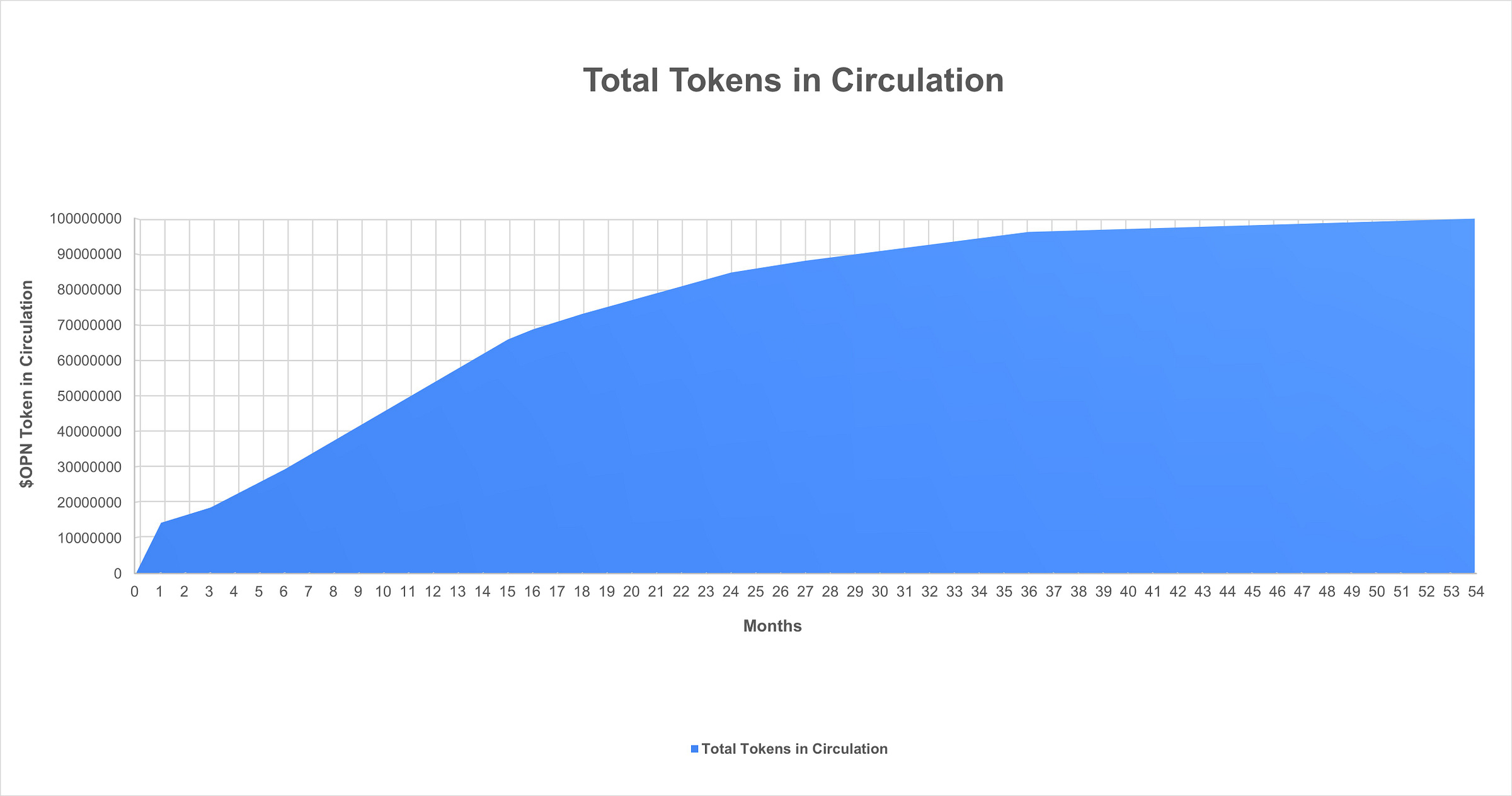

$OPN Release Schedule

Please click the image for enhanced resolution or here for interactive visualization.

Resources to Learn & Invest with OpenPad

🕸 Home: openpad.app

📖 Docs: docs.openpad.app

🧢 Twitter: twitter.com/OpenPadCitizens

📒 Web3 Newsletter: openpad.substack.com

🔊 Announcement Channel: t.me/openpad

🗣 Community Channel: t.me/OpenPadTG

🔗 Official Links: linktr.ee/openpad